Philosophy

GLP Japan Advisors Inc. is the asset manager of GLP J-REIT.

We provide best-in-class asset management services that are recognized both in Japan and internationally,

benefiting from the considerable experience of our sponsor in operating logistics facilities.

Sustainability Practices

This is the Environmental, Social & Governance Policy of GLP Japan Inc.

GLP Japan Advisors Inc. engages in the asset management of GLP J-REIT in accordance with this policy.

Environmental, Social & Governance Policy

Sustainability as a core practice in business strategy

GLP Japan Inc. has been engaged various ESG initiatives to provide values to stakeholders through business operations and contribute to society. We take ESG not only as responsibility of corporation but as critical opportunity to promote comprehensive corporate ethics and establish sustainable future. We set those initiatives for sustainability as a core practice in business strategy and target to become a global leader on ESG commitment.

We established Environmental, Social and Governance (ESG) policies as a key confirmation of our overarching commitment to integrating ESG responsibilities for the sustainability of society into our core business practices as well as monitoring and reporting. We aim to achieve sustainable society through implementation of the ESG policy and set it as a guideline for management as well as employees on business executions.

Our ESG Policy

We believe that an integrated ESG approach is required to deliver the best benefits to GLP Japan Inc. and our shareholders. This will be implemented through the following Policy:

- 1. Initiatives for environment protection

- We continue to pursue innovative initiatives and take effort to execute them which are aimed at minimizing environmental impact fall under our corporate actions to protect global environment and achieve sustainable society

- 2. Promote actions to achieve Net Zero

- Promote energy efficiency and implementation of renewable energy to accelerate actions against climate change and achieve Net Zero

- 3. Obtain third party evaluation on facility

- Target to obtain third party certifications based on the initiatives which are to develop environmentally and workers friendly specifications on facilities we manage

- 4. Treat biodiversity

- Promote taking care of plants and wild animals existing around facility, which is important to respect biodiversity and think highly of ecosystem to achieve sustainable society

- 5. Water management

- Recognize water protection as critical issue and promote efficient usage and management of water by co-work with stakeholders

- 6. Collaboration with stakeholders

- Aim to provide more added value through identification of various issues and implementation of initiatives for solution by collaboration with stakeholders

- 7. Customer support

- Make effort to solve issues in society through customer support, which are to response customer’s demand, establish efficient business operations, secure employee’s health and safety and provide comfortable working spaces and services

- 8. Coexistence with local community

- Promote chain reactive and sustainable initiatives for coexistence with local community through supporting job creation and proactive actions with local community

- 9. Maximize employee’s capability

- Aim to maximize each employee’s capability through personnel development, establishing appropriate working environment and building culture respecting individual values

- 10. Support supply chain

- Share our ESG policy with business partners on supply chain and provide continuous support

- 11. Response to disasters

- Aim to improve disaster prevention system not only in facility but for local community through providing facilities well-equipped with safety and various services, BCP initiatives and cooperation with local government

- 12. Improve productivity and efficiency with technology

- Improve productivity and efficiency of social infrastructures through investment, development and proactive use on technologies and innovations

- 13. Proactive involvement on social contribution activities

- Proactively involve on social contribution activities to contribute to local community as a member of society with common acknowledgement of our business impact to society

- 14. Establish ethical corporate culture

- Establish ethical and highly transparent corporate culture by following the ethics codes we define

- 15. ESG prospects built in process of decision makings

- Risk and opportunity on ESG are regularly implemented in process of decision makings for our business

Profile

| Company Name | GLP Japan Advisors Inc. |

|---|---|

| Location | 16F, Yaesu Central Tower, Tokyo Midtown Yaesu, 2-2-1 Yaesu, Chuo-ku, Tokyo 104-0028, JapanMAP |

| Business | Investment management business |

| Established | February 25, 2011 |

| Capital | 110 million yen |

| Shareholders | GLP Japan Inc. (100%) |

| Executive Board |

Chairman Yoshiyuki Miura President Yuma Kawatsuji Director Yoshiyuki Chosa Auditor Takayuki Kawanishi |

| Registrations and Licenses | Building Lots and Buildings Transaction Business License, granted by the Governor of Tokyo (2)92820 Discretionary Transaction Agent License, granted by the Minister of Land, Infrastructure, Transport and Tourism, Registration No. 66 Financial Instruments Business License, granted by the Director of the Kanto Finance Bureau (Kinsho) Registration No. 2547 |

| Memberships | The Investment Trusts Association, Japan / The Association for Real Estate Securitization |

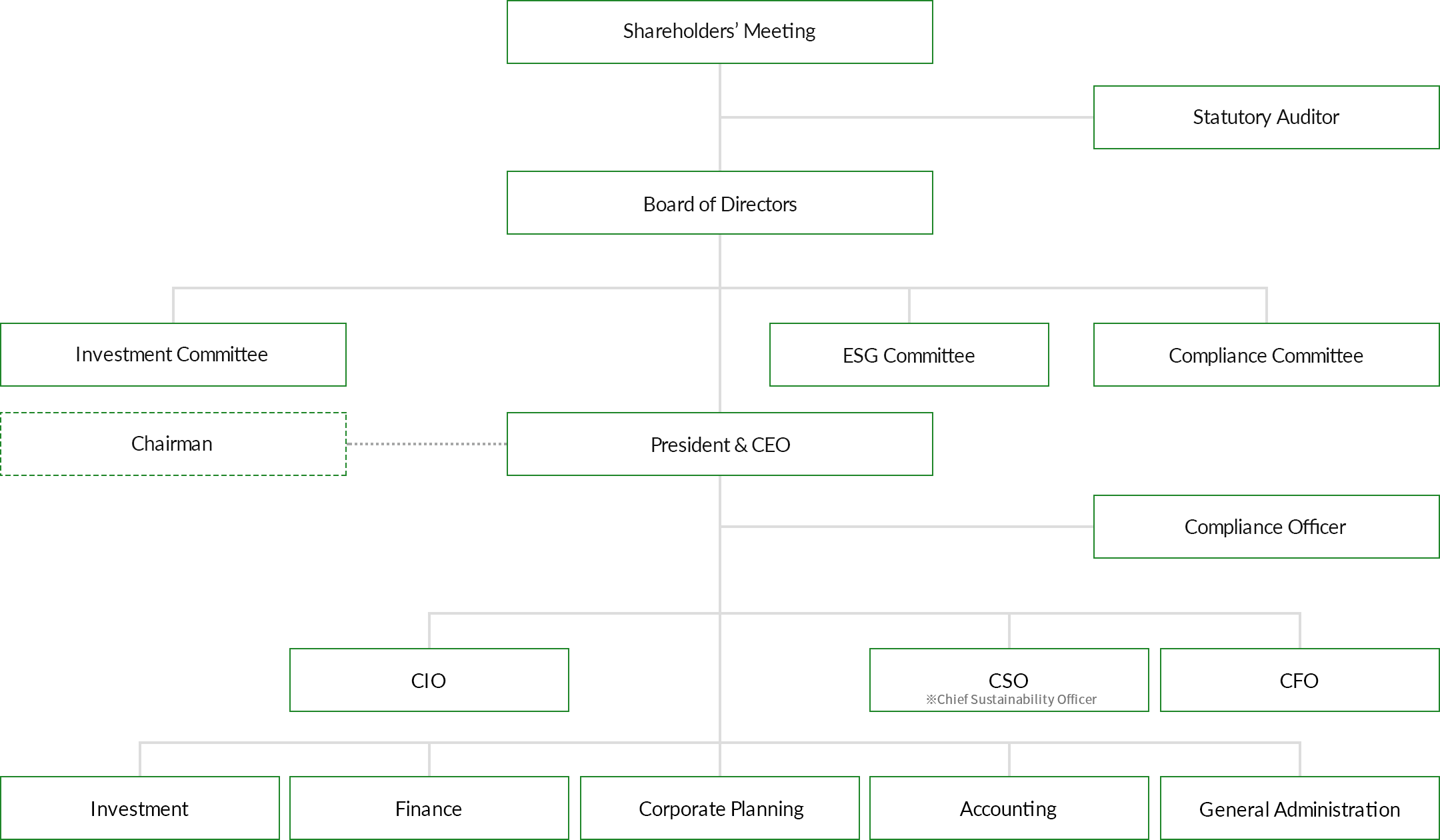

Organization

- A.Board of Directors

- The Board of Directors is the decision-making body for basic important management matters including the management strategy of the Asset Manager and in principle meets monthly to decide on basic business policies and supervise the business execution of the President. It also makes decisions regarding the selection and dismissal of the Compliance Officer, with such decisions requiring a two thirds majority vote of the directors present.

- B.Executive Officers and Departments

- The organization of GLP Japan Advisors comprised of the following departments

Investments Department: acquisition of properties the leasing and management of investment assets as well as strategic planning and the analysis of market surveys

Corporate Planning Department: Matters concerning policy formulation related to equity procurement such as public offering and investor relations

Finance Department: Matters concerning policy formulation related to borrowing and bond issuance

Accounting Department: Matters concerning general accounting operations including settlement-related operations

General Administration Department: Matters concerning general administration and operations - C.The Investment Committee and the Compliance Committee

- The Investment Committee reviews and decides on matters concerning the management of the assets of GLP J-REIT, which is engaged in the management of assets, and related matters, and the Compliance Committee aims to ensure ongoing compliance with all relevant laws, regulations and rules by the Asset Manager. In addition, ESG committee reviews and decides on matters concerning the ESG promotion and strengthening ESG initiatives.

- D.Chairman

- The Asset Manager may appoint Chairman, if necessary, upon the resolution of the Board of Directors. Chairman is able to support and advise to President within the scope of business, which is resolved by the Board of Directors.